views

The government’s industrial strategy aims to harness the best of British business, from automotive to video gaming via the City and life sciences, in order to deliver the economic growth on which all else depends.

A year in the planning with a 10-year horizon for delivery, in its final months it was hijacked by a very short-term issue; how to give industries battered by the highest electricity prices in the world a chance of competing now, never mind the 2030s.

The answer, as reported by Sky News last week, is a significant cut to bills not just for “energy intensive users” such as concrete and chemicals that already enjoy support, but to 7,000 manufacturers for whom energy is a high proportion of costs.

Money latest: Why Amazon is ‘disappointed’

They will receive around 15% off their bills from 2027, at an estimated cost of £500m a year.

Exactly who benefits will be decided after consultation but the mechanism for delivering discounts, and how they will be paid for, is already decided, and the answer tells us an awkward truth about the UK’s energy market.

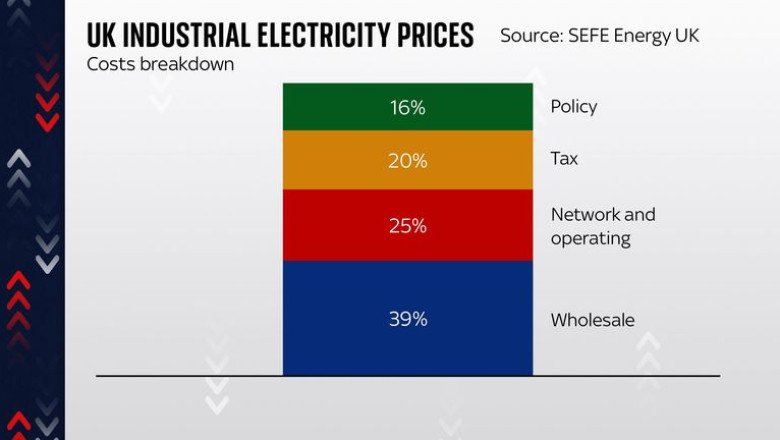

To make industrial energy prices more competitive, qualifying businesses will be exempt from paying some of the taxes and levies added to bills to incentivise the building of renewable energy sources.

These so-called “policy-costs”, which make up around 15% of energy bills, have been fundamental to the massive expansion of wind and latterly solar power, supported by successive governments over the last two decades.

This race for renewables is intended not just to lower emissions but to deliver more stable and, say Labour, cheaper bills by reducing our exposure to volatile gas prices.

The UK has been hugely successful in the first part, and green technologies are one of the eight high-growth sectors favoured in this industrial strategy.

Israel-Iran latest: Israeli strikes target ‘heart of Tehran’

Yet by choosing to discount “green levies”, the government appears to be acknowledging that taxes intended to bring down bills tomorrow are driving prices up and making the UK uncompetitive today.

It also raises the prospect that the heaviest energy users will pay less for the expansion of renewables intended to reduce emissions.

Ministers say that, unlike previous industrial discounts, the cost of this one will not be passed on to other business or domestic customers.

Instead, they say the funding will come from “headroom” created by extending price guarantees offered to renewable suppliers (known as Contracts for Difference) from 10 years to 15, and a “windfall” expected from linking UK carbon pricing to the EU system.

If that sounds like the work of Treasury officials desperate to keep an unfunded £2bn off the books it may well be, but Business Secretary Jonathan Reynolds told Sky News the scheme is compatible with the country’s long-term energy goals.

He said: “You can do both things together, you can have ambition on climate and be competitive. These changes mean no one is going to have a higher bill to pay for this, no one will have to pay higher taxes to pay for this, but how those costs are represented in the system will change over time to make sure we have competitive industries.

“There’ll be no higher borrowing, no higher taxes and no higher bills from anyone else. And ultimately if we get the increase in investment and business activity I believe this could bring about… a stronger economy overall.”

https://wol.com/industrial-strategy-targets-short-term-pain-for-long-term-gain-money-news/

Comments

0 comment