views

The core personal consumption expenditures (PCE) price index, the Federal Reserve’s preferred measure of inflation, rose slightly in August, in line with economists’ expectations.

Inflation yardsticks such as the PCE index and the Consumer Price Index measure the change in prices over time of a typical basket of goods and services.

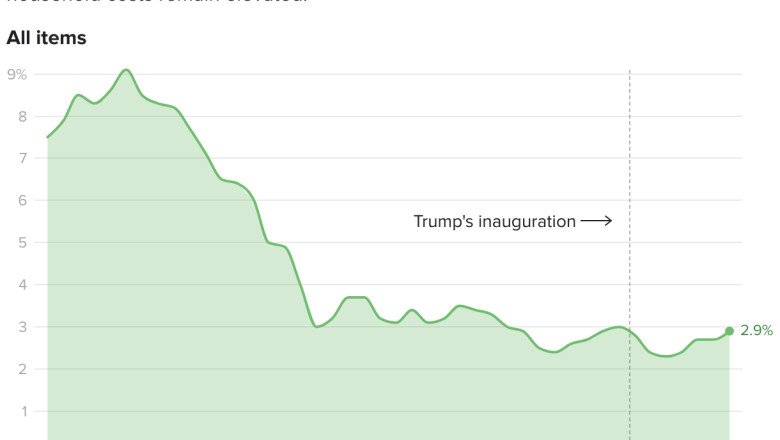

The core PCE, which excludes volatile fuel and food prices, shows a 2.9% in August on an annual basis, the same as July and in line with predictions from economists polled by financial data provider FactSet.

The PCE rose 2.7% on an annual basis, a slight increase from the 2.6% year-over-year increase in July and the highest since February, according to data released Friday by the Commerce Department.

Inflation has come down since rising prices prompted the Fed to raise its benchmark interest rate 11 times in 2022 and 2023. But annual price gains have remained stubbornly above the central bank’s 2% target. The Consumer Price Index (CPI), another key measure of inflation that tracks the change in prices on everyday items, also ticked higher last month.

The ongoing strain of higher prices is taking a toll on Americans. A CBS News poll released earlier this month showed many are souring at the state of the economy. Two-thirds of the 2,344 U.S. adults polled said prices are still going up, with the same amount saying they expect prices to keep escalating in the coming months.

Last week, the Fed went ahead and reduced the rate for the first time this year, lowering borrowing costs to help a deteriorating U.S. job market. But it’s been cautious about cutting, waiting to see what impact President Donald Trump’s sweeping taxes on imports have on inflation and the broader economy.

For months, Trump has relentlessly pushed the Fed to lower rates more aggressively, calling Fed Chair Jerome Powell “Too Late” and a “moron” and arguing that there is “no inflation.”

It’s widely expected that the Fed will cut rates at its next meeting, which is scheduled for Oct. 28 – 29.

“This inline PCE today can keep the focus of the Fed on their full employment mandate, which will give them room to continue normalization of the Fed Funds rate,” Art Hogan, chief market strategist at investment firm B. Riley Financial, said in an email note.

Last month, Trump sought to fire Lisa Cook, a member of the Fed’s governing board, in an effort to gain greater control over the central bank. She has challenged her dismissal in court, and the Supreme Court will decide whether she can stay on the job while the case goes through the judicial system.

The Fed tends to favor the PCE inflation gauge that the government issued Friday over the better-known consumer price index. The PCE index tries to account for changes in how people shop when inflation jumps. It can capture, for example, when consumers switch from pricier national brands to cheaper store brands.

More from CBS News

https://wol.com/inflation-held-steady-in-august-in-line-with-economist-forecasts/

Comments

0 comment